Digital Saving Apps: How many times have you broken your pot to take money out of the pig’s trough? If you’ve done this before, you are aware of the desire to open the pot and remove the money. But this was a time-tested way of saving money. Want to discover how to save anytime you spend in this day and age? then continue reading this article.

We use a variety of tactics to save money for our future requirements. In the past, we kept our money in piggy banks. Every time we have an extra cent, we put it in a piggy bank and wait for it to fill up. In this manner, we amass a substantial sum of money with modest savings.

This is a conventional way, as was already explained, but we also have the luxury of using modern technology today. By making use of the advantages of digital saving tools, we can now automate our savings without adding any additional work. These apps are made to increase savings by investing a little portion of daily expenditure in gold or in various portfolios that, in the long run, generate large profits.

Best Daily Digital Saving Apps

What Are Apps for Digital Saving?

Using technology and AI, digital saving apps make saving easier. These apps assist you in making every single cent count while also earning interest. You can set a goal for your future spending and begin saving today. You will develop the habit of saving money when you see yourself making progress toward your goal, which will inspire you to keep going.

Top 5 Apps for Digital Saving

There are a lot of digital saving apps available on the market, but the following are the greatest ones you should use to profit.

1. Gullak

The word “Gullak” is likely extremely familiar to many of you because we frequently use it to refer to modest sums of money that we save. The goal-based saving tool Gullak supports consistency in saving as well as progress toward your saving objective. We invest the money we save in Gullak in digital gold, which is 24-karat pure gold. In this manner, you can take advantage of an increase in the price of gold to earn some interest in your investments.

Set your goal at as little as Rs. 10 each day, and use the autopay feature to completely automate the saving process. Currently, this software supports autopay from PhonePe, BHIM, and PayTM, three UPI services. You can change your contribution at any moment, as well as suspend or cancel your autopay.

The ability to reduce your spending is this app’s most important feature. Every time you make a digital purchase, the system automatically rounds up the cost and invests in digital gold. For instance, if you pay Rs 194, it rounds the amount to the next 10 and invests the Rs 6 that is left behind. Through the accumulation of these tiny savings, a respectable sum of money is amassed.

Features of Gullak

- It makes investments in Augmont’s digital gold, where the price of purchasing and selling is dependent on the wholesale market price.

- flexibility to alter the goal’s term, the autopayment amount, and the multiplier.

- For investments in gold under 30gm, no KYC is required.

- Reducing your spending gives you the option of multiplying your extra change by a selected multiplier of 2X, 5X, or 10X.

- Withdraw your funds through UPI, or have your gold physically delivered to your door.

2. Spenny

With the help of Spenny, a platform for investing spare change, you can automate your saving behavior. Although it functions similarly to Gullak, this software has a few advantages. Every time you make a digital purchase, the system records the transaction and, using that information, rounds the amount to the nearest 10.

It invests the entire amount you have rounded up into your chosen investment option while keeping all of your money in a cart. The cart has a minimum threshold limit that you’ve chosen, and once that limit is reached, it invests your funds.

Let me dispel the most frequent misunderstanding: every time you execute a transaction, the money is not taken out to round up. When the amount of spare change surpasses the level that you specify, the money is only automatically deducted from your account.

Features of Spenny

- Since there is no lock-in period, you can take your money out whenever you like.

- It offers a variety of investment alternatives, including digital gold, mutual funds, and penny-wise.

- tracks all of your purchases, whether they are made with a debit card, credit card, UPI, or net banking.

- With Spenny, one may effortlessly begin their investing and saving journey with just Rs 10.

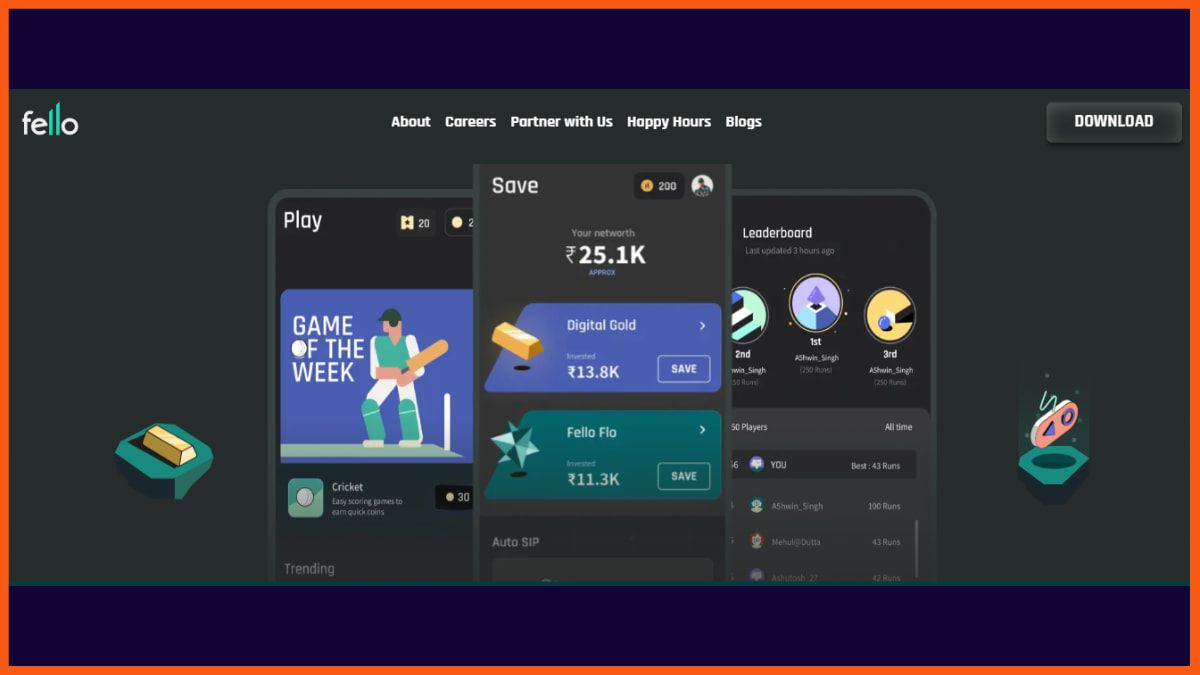

3. Fellow

With the excitement and joy of built-in games, the digital saving software Fello enhances the saving experience. It provides fellow friends and digital gold as two possibilities for investing money to help you save. Any of these two choices are available to those who want to increase their savings and earn interest. Augmont, a government, BIS, and NABL authorized Gold provider, provides Fello’s digital gold.

Users can participate in fun games and compete for prizes in addition to saving and investing in Gold and Fello Flo. For each rupee you save using this app, you receive a token that may be used to play games. Additionally, you are eligible to win a tombola ticket for every Rs 500 you save each week.

If your Tambola ticket number matches the leaderboard number, you win a prize similar to that of a lucky draw coupon. The draw number is announced every Friday at 6:00 PM.

Features of Fello

- If you choose Fello Flo, you will receive a fixed return of 10%, which is a respectable return when compared to other fixed investment options. This return could alter at any time.

- In addition to the Fello Flo, a reliable supplier, Augmont, also offers the Digital Gold investment choice.

- Every time you make a financial sacrifice, you can win a Fello token and use it to participate in games.

- The minimum and maximum savings amounts are 100 and 1,000,000 rupees, respectively.

4. Cred

Cred is a credit card management app that offers outstanding credit card-related services that ultimately assist you in making significant financial savings. The use of credit cards is now highly widespread, and most people hold many credit cards at once. Only if you use credit cards responsibly can you reap their many advantages, and this is where Cred excels.

By serving as a reminder of the due date, it aids in prompt payment of your credit card balance. You can keep tabs on all of your credit cards at once, including their usage, EMI payments, balance due, and many other things. It not only teaches you how to use credit cards responsibly but also exposes the extra fees these cards come with.

You can get free credit ratings from reputable credit rating companies like Experian and CRIF. When you apply for membership, Cred examines your credit score and if it is higher than the required score, it accepts you as a member. You can only join Cred if you meet the eligibility requirements.

Features of Cred

Every time you use this app to pay a credit card bill, you’ll receive Cred coins, which you can use to unlock special incentives.

This software employs artificial intelligence to give you data about your spending habits and usage because your credit score is based on your credit behavior.

No longer is it necessary to download different apps for each of your cards because there are several credit card management features in one app.

You may quickly and easily check your CIBIL score if you’re a Cred member.

5. Jupiter

Jupiter is a federal bank-backed platform for managing digital assets that are packed with features for banking, investments, managing debit and credit cards, saving money, and tracking transactions. For future purchases, Jupiter provides savings buckets. You can keep track of your money for your objective and maintain discipline by using this pot.

In addition to saving, you can invest directly in mutual funds without paying a commission. You don’t have to pay any penalties for SIP defaults because these mutual funds are no-penalty investments.

Another noteworthy aspect of this application is a zero-balance account with no FX fee. Similar to Fi money, you can set up your bank accounts and access a single dashboard to view all of your transactions and bank balances. It offers a debit card called Jupiter that has no yearly maintenance fee. Every time you use this card to make a purchase, you’ll receive a 1% reward. You may also freeze and sleep the card with a single tap.

Features of Jupiter

- Detailed information on every purchase made using one of your bank accounts.

- Easy-to-use interface for managing everything at once.

- Get a 1% rebate on UPI purchases in addition to debit card transactions.

- Up to Rs. 5 lakhs in deposits are guaranteed.

- Once a year, one demand draught is free.